People often buy a put choice for defense against a fall regarding the price of a stock or ETF. Traders searching for income perhaps looking for a secure phone call approach. In terms of possibilities, it can be easy to get weighed down by the jargon. Check out so it movies to learn the fundamentals instead a new code.

Increasing Profits: A comprehensive Possibilities Exchange Means: trade neupro 100 official website

Including, if you buy a contract during the a strike cost of $fifty a portion, you would not get below you to definitely matter, even when the asset’s market price fell so you can $0 (the possibility blogger try forced to find the offers). Concurrently, in case your asset’s value leaps beyond their market worth, you might prefer not to exercise thooughly your solution to offer and maybe gain promoting the brand new shares downright. The fresh hit price is the fresh predetermined rate where the root asset are available otherwise marketed.

Leverage & Exposure

Doing this makes it possible to get the hang out of options trading and you may see potential benefits and drawbacks rather than in reality placing currency on the line. Not merely do you want to learn different options trading tips as well as get a full picture of the risk trade neupro 100 official website inside it. Let’s say the advanced is actually $ten per share, as well as the choices offer is for the standard one hundred offers. It indicates you’re going to have to shell out a whole superior away from $step 1,100 on the option. Choices are a kind of derivative, and therefore they obtain its worth away from a fundamental asset.

- Now the newest homebuyer must pay the market speed as the offer has ended.

- And you can connected financial institutions, Players FDIC and you can entirely had subsidiaries from Lender of The usa Firm (“BofA Corp.”).

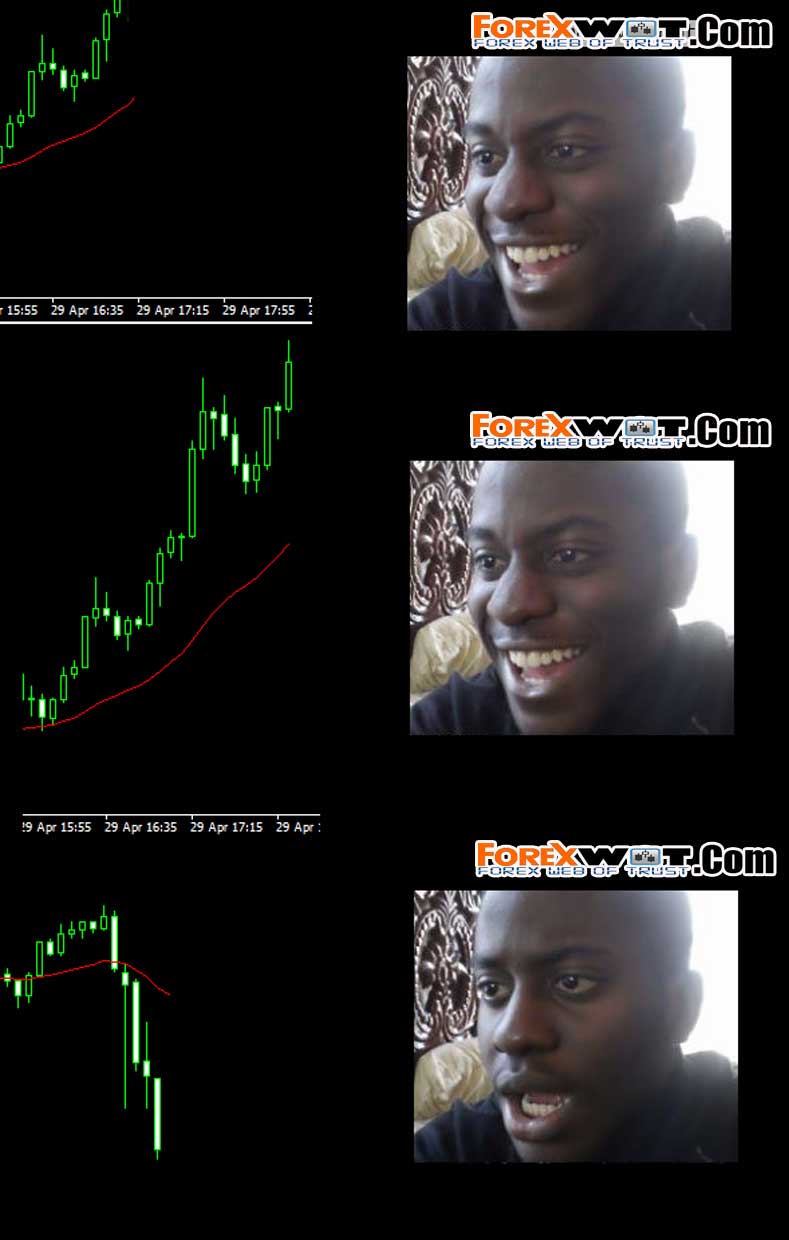

- This shows the prospect of funds utilizing the influence one to alternatives trade allows.

- NerdWallet will not and should not guarantee the precision or usefulness away from any guidance in regard to your individual items.

Speculating which have an excellent call solution—rather than buying the inventory downright—is of interest for some traders as the alternatives render control. An out-of-the-money call solution might only prices a number of bucks if you don’t cents compared with the full cost of a $a hundred stock. The choices on the lower strike price will be the least risky but furthermore the priciest.

Should your inventory rates really does boost, you can workout your option making a profit. If your business you possess options for is actually in public areas traded, the value of their stock options hinges on the modern well worth of one’s stock. Assess exactly how much it will be value if you were to buy or offering what number of shares you have an alternative to own in the personal rates. Next, determine exactly how much it could be worth to find or sell the same number of offers during the cost of your decision. Carried on the fresh analogy, an investor purchases four name deals to own January from the $150. Should your inventory exceeds $150 during the conclusion, the new buyer can buy five hundred shares at this price.

This gives the proper but not an obligation to shop for an enthusiastic advantage from the a predetermined rates. And, choices wanted an extensive comprehension of cutting-edge steps, and you can lack of knowledge is enhance threats, leading to high problems and you may economic losings. Intended volatility (IV) is perhaps the most challenging so you can measure, however it is important to discover to own options investors.

We do not highly recommend particular things or business, yet not get discovered a percentage regarding the team we render and you will feature. Anybody who sold myself the option has you to as the funds, and they also contain the family. This is basically the property value the option, whether or not you’lso are the consumer or even the vendor. As well as the Greeks, meant volatility (IV) is an additional vital aspect of a choice’s price. A change in IV alone might have a dramatic influence on the cost of an alternative. In conclusion a situation, see “intimate unlock” on the step case and you may go into their speed and you can buy type of.

As well, the fresh magnitude of your own flow must outstrip what the alternatives business priced inside through implied volatility. But not, of numerous active choices buyers never ever plan to contact the root shares on their own. As an alternative, it trade options – possibly in different combos known as “spreads” – on the intent away from taking advantage of changes in the brand new premiums, otherwise cost, of your own solution deals.

Fast-forward to the newest conclusion date, in which today, stock A need increased to $70. Which call option would be really worth $20, since the inventory An excellent’s pricing is $20 higher than the brand new strike cost of $50. In comparison, a trader perform cash in on a made use of option should your underlying stock were to fall less than their hit price by termination time. Buyers capture combinations away from long and short solution positions, with assorted strike costs and you can conclusion times, for the intended purpose of deteriorating profit from the choice superior with restricted risk. Such, if you very own offers from a family, you could buy place choices to decrease possible losings from the knowledge the brand new stock’s rate falls. That is you to reason why choices for greater market benchmarks, such as the S&P five-hundred, are commonly made use of as the a great hedge to have prospective refuses on the industry in the short term.

Not merely are you required to invest a made when buying choices, however you will also have to expend a payment to the representative and you can short regulatory charge. Due to this, they always makes sense to weighing most likely will set you back up against prospective profits and you will loss, before purchasing a choice deal. Or even the funds might end right up are lower than your thought, otherwise your own losses greater than imagined. To your client of an alternative, the most obvious hazard is that the underlying resource doesn’t disperse from the wished assistance, forcing these to let the bargain expire worthless. Get this occurs usually sufficient, also it can total up to large losings — possibly more than if you just bought and you can held the underlying property.