Posts

Which have a great $fifty,000 put, you’ll need $150, and a balance of $a hundred,000 might have made you $2 hundred. M&T Financial considering a funds incentive away from $350 once you unsealed a great MyChoice Advanced Savings account. To achieve the main benefit, you had to keep up the common month-to-month harmony with a minimum of $10,100 for June and you can July. Flushing Financial lets the newest Done Checking people to earn as much as $dos,five-hundred in the a money added bonus after they manage the very least average balance for a few days.

Online-merely banks have the same has because the antique financial institutions and often several a lot more advantages away from average stone-and-mortar institution. Beginning a checking account takes some investigating discover your ideal location. Very first, think about what points are important to you on your financial.

Amazingly, what number of banking institutions with the ChexSystems is the reason over 80% of all the loan providers in the country. Certain financial institutions, for example PNC otherwise All of us Lender, could possibly get make it a check to clear within the same go out in the event the placed before ten p.yards. If you try to help you deposit the new look at after that timing, you’ll have likely to go to before the following day for this to pay off. Mobile look at dumps generally take anywhere between around three and you can 5 days to help you processes, make certain and you may clear. In some instances, simply part of the look at will get obvious instantly, as well as the rest clears the following working day.

American Air companies Government Borrowing from the bank Union

Discover Lender, Affiliate FDIC, try the full-provider financial institution which can manage all your financial means. As well as an entire listing of put accounts, Come across also offers private old age account points, playing cards and private, scholar and mortgage brokers. Readily available nationwide, Wells Fargo provides a great $825 acceptance incentive once you unlock an alternative company savings account and keep the very least balance.

Laurie Sepulveda is actually a good MarketWatch Instructions people elderly blogger whom focuses in writing in the unsecured loans, house guarantee fund, mortgage loans and financial. She stays in Vermont possesses educated and you will https://vogueplay.com/uk/rizk-casino-review/ discussed individual fund for more than ten years. Places are FDIC insured, as much as appropriate limitations, from the Bancorp Bank, Letter.A great. And Stride Financial, N.A., Professionals FDIC, FDIC deposit insurance rates handles only up against the inability out of an insured bank. Particular conditions should be met to have citation-as a result of deposit insurance to apply.

Zero lowest balance becomes necessary on the 2nd Chance Savings account, there are no added costs to have deposits or check-writing. Pages get access to 100 percent free mobile banking, online banking, and you can bill spend capability. As well, customers qualify for an atm/Credit card debit credit.

Scient Government Borrowing Union

Using a totally free bank account can save you currency and you will provide finest banking benefits. Whether or not you desire a classic financial that have branch availability otherwise an enthusiastic on the internet financial having more advantages, there’s a choice for everybody. Compare features, see invisible costs and choose the new account that meets your existence.

Account holders is also lender electronically or perhaps in people from the certainly one of Funding You to definitely’s of numerous bodily twigs. The fresh UFB Direct Collection Checking account provides a substantial rate of interest from 4.01% APY. And, there aren’t any monthly fees without minimal harmony to open up. Unlock a business Family savings and sustain a minimum average ledger harmony of at least $5,100 to your very first three statement time periods. Be sure to complete no less than 20 qualifying PNC Bank Visa organization debit credit purchases in the first around three report time periods. You must have five qualifying transactions in the very first 90 days of enrollment.

Ideas on how to Discover a totally free Family savings On the web Without Deposit

SoFi’s Borrowing from the bank Understanding incentive is a simple provide centering on the newest professionals. Because of the triggering credit history overseeing (a free ability within the SoFi application), new registered users can simply earn $ten inside the benefits items. Financial institutions are not the only businesses that provide advantages for joining. I protection the major rating-paid-to-sign-up options within the another article. Banks and you may investment brokerages provide bonuses to incentivize new clients to help you discover account and you will satisfy the needs.

Royal Borrowing from the bank Connection

Look around to have banking institutions and you can borrowing unions that offer 100 percent free examining accounts no opening put, to optimize your financial self-reliance. Users may also be confident that they will not become charged any non-adequate financing (NSF) fees to have overdrafts. We provide several charges for cheap preferred features, including stop money, wire transmits, and you will certified monitors (come across Facts). Whenever a checking account try stated as the “totally free,” it relates simply to monthly repair costs. Even though they’lso are labeled totally free examining membership, certain banking companies might still costs costs for certain characteristics. Despite as the ninth-biggest bank in the U.S., Investment You to definitely works mostly because the an online lender, with only several strewn inside the-people towns.

Your claimed’t have to worry about lacking lead put to love the key benefits of a bank checking account either. Whether or not these financial models could have fallen out from favor lately, it is very important know how to fill out a deposit sneak correctly when investment your own checking or family savings. Having fun with a deposit sneak can be make sure your currency gets to the correct attraction since the smoothly and you can quickly that you could. You may also continue copies of deposit glides because the invoices to help you establish your lender approved the deal.

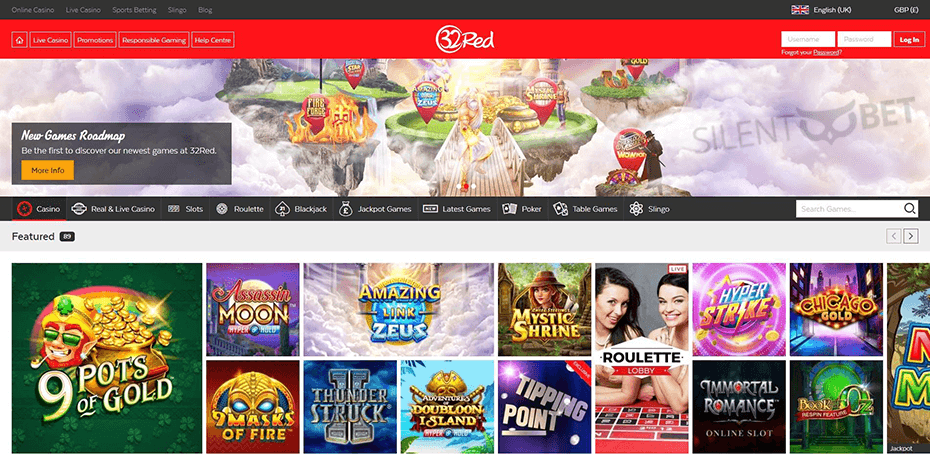

An educated zero-put extra web based casinos

But if you see the requirements, such as keeping a particular balance otherwise to make lead deposits more than a-flat number, Pursue tend to waive those people charges of many accounts. Latest is a monetary technical business, not an enthusiastic FDIC-insured financial. FDIC insurance coverage to $250,100 merely discusses the newest failure from a keen FDIC-covered lender.

I in addition to that way Ally provides high approval costs provided that because you wear’t provides a good ChexSystems or EWS fraud aware on your prior. Starting a different commission-totally free, no-put savings account ‘s the starting point, but you would be to want to keep some funds on the dated membership to pay for one continual fees you have lost to help you cancel. Earliest Citizens cannot charges fees so you can download or access Earliest Citizens Digital Financial, for instance the First Residents mobile financial app. Mobile company charge will get submit an application for investigation and text message usage. Charges get make an application for usage of particular characteristics inside First Residents Electronic Banking. To be eligible for 100 percent free Examining, you ought to sign up for receive Earliest Residents paperless statements inside two months from membership beginning.