In today’s fast-paced world of currency trading, the right tools can make all the difference. Forex trading software is designed to help traders navigate the complexities of the foreign exchange market efficiently. From automated trading systems to advanced analytical tools, these software options are invaluable for both novice and experienced traders. One such comprehensive resource is forex trading software https://exbroker-argentina.com/, which can provide additional insights into effective trading solutions.

An Overview of Forex Trading Software

Forex trading software encompasses a wide range of tools and platforms that facilitate currency trading. These applications can range from basic charting tools to sophisticated trading platforms that allow traders to execute trades, analyze market trends, and manage their portfolios.

The Importance of Choosing the Right Software

Selecting the right Forex trading software is crucial for success in the currency markets. With countless options available, understanding what to look for can significantly impact a trader’s performance. Key aspects to consider include:

- User Interface: A user-friendly interface is essential for traders, especially those who are new to the market.

- Features and Tools: Look for software that offers robust features, including real-time data, analytical tools, and automated trading capabilities.

- Customization Options: The ability to tailor the software to fit individual trading strategies is beneficial.

- Compatibility: Ensure the software is compatible with various devices, including desktops, tablets, and smartphones.

- Customer Support: Reliable customer support can make a significant difference in resolving issues as they arise.

Types of Forex Trading Software

Forex trading software can generally be categorized into three main types: standalone trading platforms, automated trading systems, and charting software.

1. Standalone Trading Platforms

Standalone trading platforms are comprehensive applications that allow traders to execute trades, analyze market trends, and manage their portfolios all from one interface. Popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used due to their versatile capabilities and extensive community support.

2. Automated Trading Systems

Automated trading systems, also known as algorithmic trading systems, require minimal manual intervention. They employ pre-defined algorithms to analyze market conditions and execute trades on behalf of the trader. This can help capitalize on market movements more efficiently, eliminating the emotional aspects of trading.

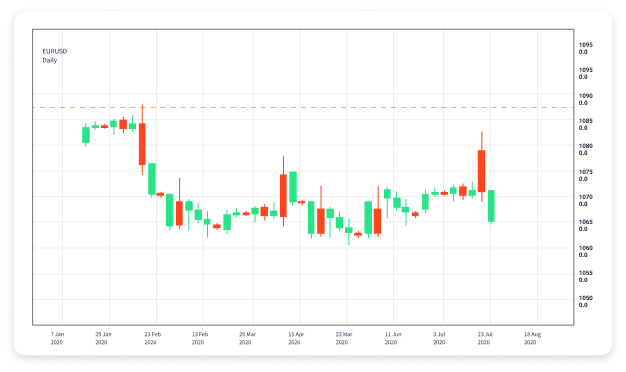

3. Charting Software

Charting software provides traders with powerful analytical tools to visualize market data and trends. These tools can include features such as technical indicators, oscillators, and customizable charts. While charting software is often integrated into standalone trading platforms, dedicated charting software can offer advanced functionality for serious traders.

Key Features to Look For in Forex Trading Software

When exploring Forex trading software, it’s essential to choose options that offer features tailored to your trading style. Here are some must-have features:

- Real-Time Data: Access to live market data ensures that traders can make informed decisions promptly.

- Various Order Types: The ability to execute market, limit, stop-loss, and other order types can enhance trading flexibility.

- Risk Management Tools: Features such as margin calculators, stop-loss, and take-profit orders are critical for managing risk effectively.

- Backtesting Capabilities: The option to test strategies using historical data is invaluable for evaluating performance before implementing trades.

Popular Forex Trading Software to Consider

There are several widely used Forex trading software options, each with distinct strengths:

1. MetaTrader 4 (MT4)

MT4 remains one of the most popular Forex trading platforms among retail traders. Its extensive charting capabilities, user-friendly interface, and vast library of indicators make it a go-to choice.

2. MetaTrader 5 (MT5)

An upgrade from MT4, MT5 includes additional features such as more timeframes, an economic calendar, and advanced order types, making it suitable for multi-asset trading.

3. cTrader

cTrader is known for its intuitive interface and high-level customization options. It also offers a range of analytical tools and supports algorithmic trading through cAlgo.

4. NinjaTrader

NinjaTrader is particularly popular among futures traders, but it also supports Forex trading. Its extensive backtesting features and customizable strategies are highly regarded.

The Future of Forex Trading Software

As technology continues to evolve, so too does the Forex trading landscape. Here are some trends expected to shape the future of Forex trading software:

1. Artificial Intelligence (AI) Integration

AI-powered tools are increasingly being incorporated into trading software, providing traders with advanced predictive analytics and automated strategy optimization.

2. Enhanced Security Features

With increasing threats to cybersecurity, Forex trading software is placing a greater emphasis on robust security measures to protect trader data and funds.

3. Mobile Trading Solutions

The demand for mobile trading continues to rise. Future trading software will likely focus on improving mobile functionalities to cater to this growing user base effectively.

Conclusion

The choice of Forex trading software can be a game-changer for traders looking to optimize their performance in the currency markets. By understanding the types of software available, identifying key features, and staying informed about emerging technologies, traders can find the right tools to enhance their trading strategies. Whether you are a newcomer or a seasoned trader, investing time in selecting the best Forex trading software will ultimately lead to more informed decisions and potentially higher profits.

Always remember that effective trading is not solely reliant on software; a solid understanding of the market, ongoing education, and a well-planned strategy play integral roles in success.